In today’s digital-first economy, payments power everything. From players cashing out winnings in iGaming, to gig workers receiving wages, to eCommerce businesses managing global transactions, money movement is the foundation of modern business. But behind every smooth transaction is a payments system-and integrating one is often a pain point for companies of all size.

Traditional payment integrations can take months, require costly developer resources, and force businesses to adapt to rigid system. Worse, they can create gaps in compliance and fraud detection, leaving businesses exposed to risks.

That’s why AptPay was built differently. Our mission is to make money-in and money-out simple, secure, and fast to integrate-so businesses can stay focused on growth, not technical hurdles.

Why Payment Integration Has Been a Pain Point

Most businesses know they need modern payments infrastructure- but the integration process often stops them in their tracks. Consider this:

- 68% of companies cite integration challenges as the biggest roadblock to adopting new payment technology.

- 44% of merchants report losing revenue opportunities because it took too long to roll out payments upgrades.

- The average integration timeline for traditional providers is 8-12 weeks, eating up developer hours and delaying go-to-market strategies.

For industries where speed equals competitiveness-like iGaming, Fintech, eCommerce, and gig platforms-these delays aren’t just inconvenient; they’re cost.

Imagine a gaming operator that launches a new platform but can’t offer fast withdrawals for three months because of integration delays. Players churn. Revenue slips. Brand trust suffers. Integration complexity isn’t just an IT problem-it’s a business problem.

How AptPay Transforms the Integration Experience

AptPay is designed to eliminate these barriers. With a flexible, API-driven platform, businesses can launch payment solutions in days-not months.

- Faster Time-to-Market

- Go live in as little as 7-10 days, compared to industry averages of 2-3 months.

- Sandbox environments allow businesses to test and validate transactions before going live, reducing errors.

- Built-In Compliance and Security

- KYC (Know Your Customer) and AML (Anti-Money Laundering) checks are integrated directly into the platform.

- Fraud detection and monitoring tools help reduce risk from the very first transaction.

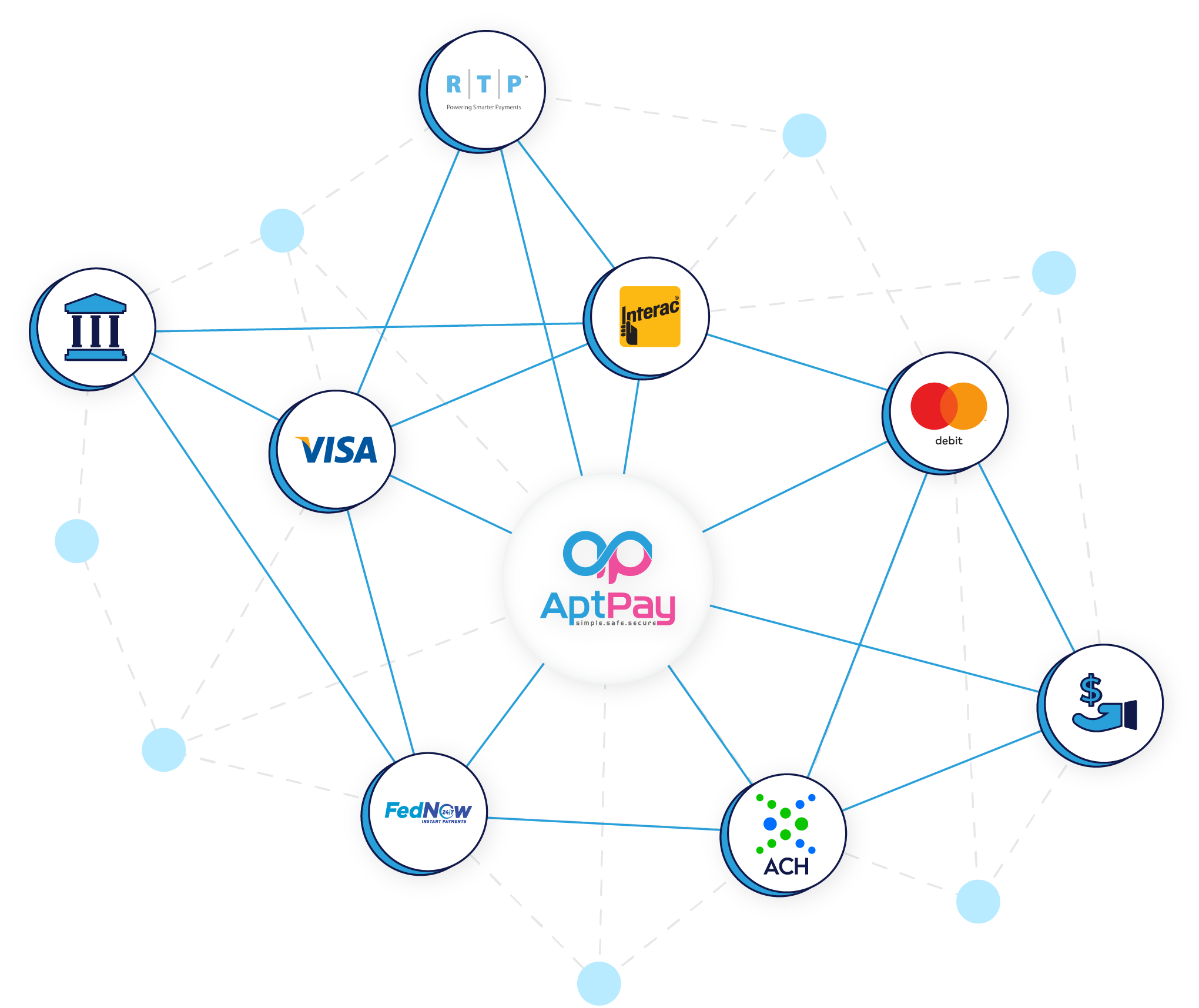

- API-First Architecture

- Flexible APIs connect with 90% of common platforms, eliminating the need for costly custom builds.

- Works across industries: iGaming operators, Fintech startups, gig apps, and global eCommerce businesses.

- End-to-End Visibility

- Full reporting dashboards and transaction traceability provide transparency.

- Real-time status updates reduce customer inquiries and support tickets.

- Dedicated Support

- AptPay’s integration specialists provide hands-on guidance every step of the way.

a 24/7 support team with a 95% satisfaction rate ensures businesses are never left stranded.

The Number: Real Business Impact

When businesses choose AptPay, the results speak for themselves.

- Operational Efficiency

- Businesses cut setup time by up to 60%, allowing them to move faster than competitors.

- Clients report saving 25% in operational costs by streamlining workflows.

- Improved Customer Experience

- Payment-related support tickets drop by 35% due to real-time status tracking.

- 30% fewer failed transactions thanks to real-time bank account verification.

- Faster Growth

- Clients see up to 40% faster go-to-market speed compared to legacy integrations.

- In the iGaming sector, operators offering instant withdrawals report 20% higher player retention rates.

- Industry-Wide Benefits

- 82% of iGaming players say fast withdrawals are their top priority when choosing a platform.

- 73% of businesses say seamless integration is critical when evaluating new tech vendors.

- Gig economy platforms that offer instant payouts see worker satisfaction increase by 45%, directly reducing churn.

Why Easy Integration Matters More Than Ever

Payments re no longer just a back-offline function-they’re customer experience driver. In fact:

- 67% of consumers say they would switch providers after just one poor payment experience.

- Failed or delayed payments lead to a 30% increase in churn.

- Businesses that can offer instant, secure, and reliable payouts have a measurable competitive advantage.

For industries like iGaming, where the entire experience is built around speed and excitement, players expect withdrawals to be just as instant as deposits. For gig workers, fast payout build trust and loyalty. For eCommerce, smooth integration ensures global reach without losing time or money.

AptPay in Action: Real Use Cases

- iGaming Operators

- Players deposit instantly an expect the same speed when cashing out. AptPay enables withdrawals via Visa Direct, Mastercard Send, ACH, and Interac ensuring near real-time access to winnings.

- Fintech Startups

- Launching new apps often means racing against time. AptPay’s quick integration and built-in compliance help fintech innovators scale without sacrificing security.

- Gig Economy Platforms

- Workers prefer platforms that pay instantly. AptPay helps gig apps retain workers and reduce turnover by enabling same-day payouts.

- eCommerce Merchants

- From refunds to supplier payments, AptPay ensure global businesses can move money in and out efficiently, with fewer errors and delays.

The Future of Payments is Frictionless

Integration no longer needs to be a roadblock. With AptPay, businesses across industries can move money securely, transparently, and in real-time-without wasting months on development.

Our approach is simple: easy to integrated, fast to deploy, built to scale.

When payments just work, businesses grow faster, customers stay happier, and trust builds naturally.

Ready to Experience Seamless Integration?

Don’t let outdated systems or long integrations hold your business back. AptPay is redefining payments for industries where speed, compliance, and customer trust matter most.

👉 Learn more about AptPay and see how easy integration can unlock growth.